Traders Blog - Analysis, Strategies, News and more: Tag - Forex Market

BOJ Holds Steady: Adachi's Cautious Tone Signals Continued Policy

So, things are getting interesting at the Bank of Japan (BOJ). Seiji Adachi, one of the big shots on the board, recently dropped some hints that they're not in a rush to change their super loose money policy. Despite Governor Kazuo Ueda suggesting tw...

GBPUSD - correction or a reversal?

So, the GBPUSD currency pair has been on a bit of a downward slide, but here`s the twist – there`s a chance it might bounce back up in the short term.You see, the market isn`t really expecting the US or UK central banks to raise interest rates anytim...

Fed and RBNZ Hold Rates Steady, But What's Next?

So, it seems like the Federal Reserve (Fed) made a move that was widely expected. They increased the interest rates by 25 basis points (bps), but other than that, they didn`t make any significant changes to their policies. Fed Chair Powell emphasized...

China's Copper Connection: Price Swings and Recent Setbacks

You know how copper is like that friend who hangs out a lot with China? Well, China loves using copper a ton, and when China`s doing great, it wants more copper, so the prices go up. But when China`s not doing so hot, it doesn`t want as much copper,...

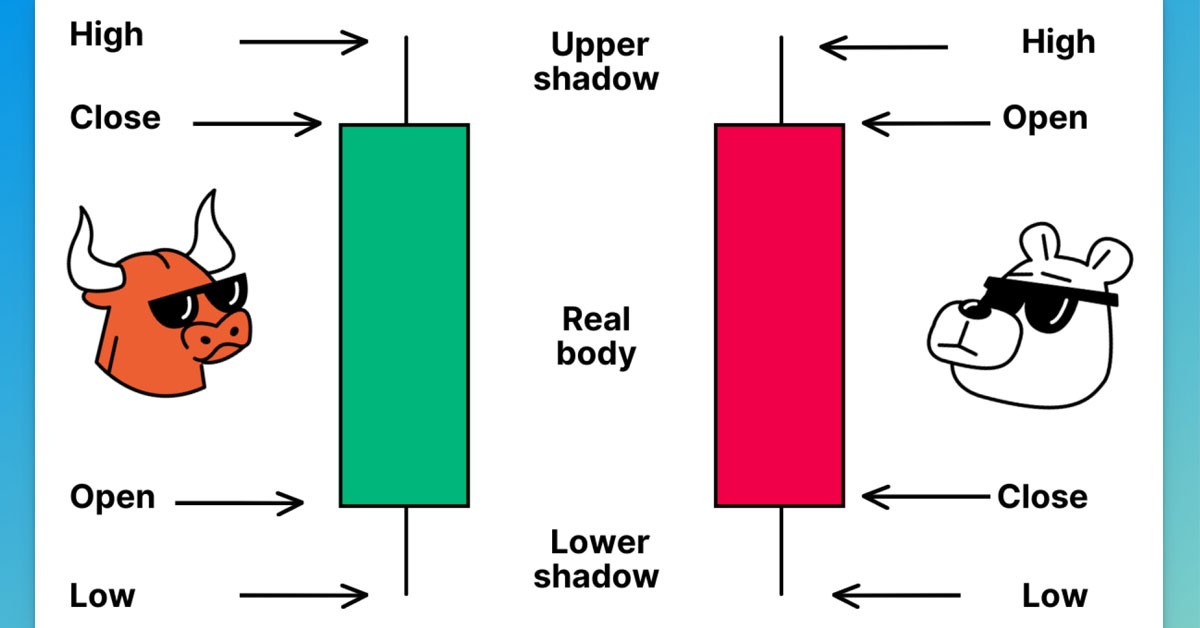

How To Read Candlesticks

Candlesticks and candlesticks patterns are the most important thing you will need to understand when trading. Without understanding candlesticks you can’t read prices much less make accurate trading decisions about what’s going to happen next. So hav...

Tags

Subscription